Small fleet operators should invest in the best coverage options by securing comprehensive fleet insurance through top-rated trucking insurance providers. These specialized policies are tailored to address small fleet liability coverage, crucial for legal protection post-accidents, and include robust cargo protection plans that safeguard goods against loss or damage. Additionally, these insurers offer physical damage insurance to protect trucks from non-collision events like theft, vandalism, or natural disasters. Opting for multi-truck coverage packages not only provides a cost-efficient solution but also broader benefits compared to individual vehicle policies. By choosing an insurer with expertise in trucking, fleet operators can ensure they have a comprehensive suite of protections that align with their operations, enabling them to operate confidently and efficiently while safeguarding against various risks on the road.

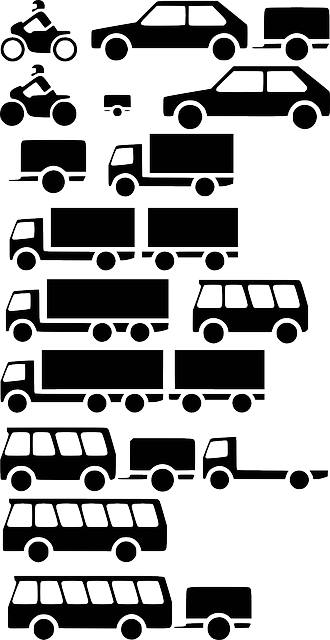

When safeguarding your small fleet’s operational integrity and financial health, the choice of insurance is paramount. This article offers a comprehensive guide tailored for small fleet operators seeking the best coverage options available. We explore top-rated trucking insurance, delve into comprehensive fleet insurance essentials, and highlight tailored policies designed for multi-vehicle operations. From securing your assets with robust cargo protection plans to addressing physical damage risks, understand how to navigate insurance landscapes to ensure your small fleet is well-protected against unforeseen events. Key topics include the nuances of securing small fleet liability coverage and identifying the most suitable multi-truck coverage options to align with your business’s specific needs.

Maximizing Protection for Your Small Fleet: A Guide to Top-Rated Trucking Insurance

For small fleet operators seeking the best coverage, it’s imperative to consider comprehensive fleet insurance that addresses a myriad of potential risks on the road. Top-rated trucking insurance providers offer tailored policies designed to protect your operation from various angles. These include small fleet liability coverage, which is indispensable for safeguarding against claims and lawsuits resulting from accidents involving your vehicles. Additionally, comprehensive plans often extend to cargo protection plans, ensuring that the goods you transport are also covered against loss or damage during transit.

When evaluating insurance options, it’s crucial to look beyond standard policies and explore multi-truck coverage packages. These can be more cost-effective and provide a broader range of benefits than purchasing individual policies for each vehicle. Physical damage insurance is another essential component that covers your trucks against non-collision perils such as theft, vandalism, or natural disasters. By selecting an insurer with a robust reputation and a deep understanding of the trucking industry’s nuances, small fleet operators can navigate their coverage needs confidently, knowing they have a comprehensive suite of protections in place.

Navigating Comprehensive Fleet Insurance: Coverage Essentials for Small Fleet Operators

For small fleet operators seeking the best coverage, understanding comprehensive fleet insurance is paramount. Top-rated trucking insurance policies are designed to address the unique needs of each operation, offering tailored fleet policies that encompass all critical aspects of commercial transportation. These policies often include small fleet liability coverage, which is essential for protecting against claims and lawsuits arising from accidents involving your vehicles. Additionally, cargo protection plans are a must-have, as they safeguard the financial impact of lost or damaged goods during transit.

When considering comprehensive fleet insurance, it’s important to explore multi-truck coverage options that offer physical damage insurance for your entire fleet. This not only includes collision and comprehensive coverage but also options like rental reimbursement and towing costs should a vehicle be out of service due to an incident. Opting for physical damage insurance can save time, money, and resources in the event of an unforeseen occurrence on the road.

Small fleet operators must evaluate their specific operational risks to determine which coverage is most suitable. Whether it’s liability, cargo, or physical damage protection, the goal is to secure a robust insurance package that aligns with your business’s size and exposure. By working with an insurance provider that specializes in trucking, you can ensure that your fleet is adequately protected against a wide array of risks, allowing you to focus on growing your business with confidence.

Tailored Policies for Multi-Vehicle Operations: Best Coverage Options for Small Fleets

For small fleet operators seeking the best coverage options, it’s crucial to evaluate comprehensive fleet insurance solutions that cater specifically to their needs. These tailored policies for multi-vehicle operations provide an array of benefits, ensuring that each truck under your command is adequately safeguarded. Top-rated trucking insurance plans often include small fleet liability coverage, which is essential for protecting against claims and lawsuits resulting from accidents or incidents involving your vehicles. Additionally, cargo protection plans are a must-have for those transporting goods, as they offer financial security against loss or damage to the cargo you carry. When selecting insurance, consider physical damage insurance as well, which covers your fleet’s vehicles in the event of collisions, theft, vandalism, or natural disasters, ensuring that your investment remains intact even when faced with unforeseen challenges on the road.

In the quest for robust coverage, small fleet operators must explore various tailored fleet policies and multi-truck coverage options available. These can include additional provisions such as contingent cargo coverage, which steps in when the primary cargo insurance has limits that are exceeded. Furthermore, understanding the nuances of each policy and how it interacts with your specific operations is key to finding the most cost-effective and comprehensive fleet insurance solution. It’s an intricate process that requires careful consideration of your fleet’s size, the nature of the goods you transport, the geographic areas you operate in, and the level of risk associated with your daily operations. By partnering with insurers who specialize in trucking insurance, small fleet operators can navigate these complexities confidently, ensuring their business remains resilient and protected on the road ahead.

Securing Your Assets: Cargo Protection and Physical Damage Insurance for Small Fleet Owners

For small fleet operators seeking the best coverage to safeguard their assets, comprehensive fleet insurance is a critical investment. Tailored fleet policies that include cargo protection plans are essential for businesses with exposure to transporting goods. These plans are designed to cover the physical damage or loss of cargo during transit, offering peace of mind against the financial repercussions of theft, collision, or other incidents. Ensuring your cargo is protected is as important as securing top-rated trucking insurance for your vehicles. Small fleet liability coverage is another key component, safeguarding against legal claims resulting from accidents involving your fleet. Opting for multi-truck coverage options not only streamlines your insurance needs but also often leads to more competitive rates, reflecting the scale of your operations and the trust you place in your insurer’s ability to provide comprehensive protection.

When evaluating insurance providers for your small fleet, consider those that offer tailored fleet policies. These are crafted to address the unique risks associated with operating a fleet of vehicles, ensuring that no aspect of your business is left exposed. A robust physical damage insurance component within your policy covers your trucks and trailers against non-collision losses like fire, hail, or vandalism. By selecting an insurer that specializes in top-rated trucking insurance, you’ll have access to coverage options specifically designed for the needs of small fleets, providing a financial safety net that allows your business to operate with confidence and security.

In conclusion, small fleet operators have a multitude of robust and tailored coverage options at their disposal to ensure their operations are safeguarded against various risks. By selecting the best coverage for small fleets through top-rated trucking insurance providers, these operators can confidently navigate the roads with comprehensive fleet insurance that addresses both liability and physical damage. Cargo protection plans further secure their assets, completing a well-rounded approach to risk management. With the insights provided in this guide, fleet owners are now equipped to make informed decisions on their multi-truck coverage options, ensuring they maintain operational integrity without compromising on the quality of insurance selected.