Small fleet operators face unique risks with multiple vehicles and drivers. Comprehensive fleet insurance offers the best coverage by addressing accidents, cargo damage, collisions, and third-party injuries. Top-rated trucking insurance providers supply tailored policies including physical damage insurance, small fleet liability coverage, and cargo protection plans. These options provide peace of mind and financial security for businesses in a competitive industry, allowing operators to focus on growth and efficiency.

In the dynamic world of small fleet operations, navigating liability risks is paramount. Understanding and addressing these challenges with robust insurance policies can safeguard your business and drivers from financial ruin. This article delves into essential aspects of liability management for small fleet operators, highlighting the significance of comprehensive fleet insurance, tailored multi-truck coverage options, and protective plans like cargo protection and physical damage insurance. Discover how top-rated trucking insurance can offer the best coverage for your unique needs.

Understanding Liability Risks for Small Fleet Operators

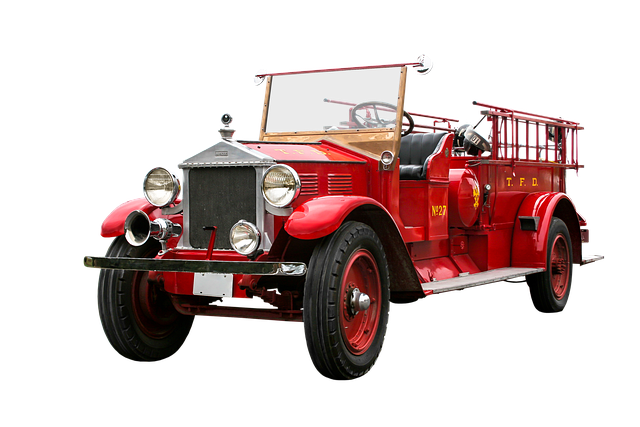

Small fleet operators face unique challenges when it comes to liability risks. With multiple vehicles and drivers on the road, ensuring adequate protection is essential for business continuity and financial security. Understanding potential liabilities is the first step in crafting a robust insurance strategy. These risks can include accidents involving cargo damage, vehicle collisions, or even third-party injuries sustained during loading/unloading processes.

Comprehensive fleet insurance offers the best coverage for small fleet operators by addressing these concerns. Top-rated trucking insurance providers provide tailored fleet policies that encompass physical damage insurance, protecting against vehicular losses. Additionally, small fleet liability coverage ensures businesses are shielded from legal repercussions arising from accidents or incidents involving their vehicles and cargo. Cargo protection plans further mitigate risks by safeguarding the value of goods transported, offering peace of mind for operators navigating a competitive trucking industry.

The Importance of Comprehensive Fleet Insurance Coverage

For small fleet operators, securing the best coverage is paramount to mitigate risks and ensure business continuity. Comprehensive fleet insurance isn’t just about meeting legal requirements; it’s a strategic move to protect against potential losses that can cripple a small business. Top-rated trucking insurance policies offer multi-truck coverage options tailored to meet the unique needs of various vehicles within a fleet, from trucks and trailers to specialized cargo carriers.

Beyond physical damage insurance, which safeguards against wear and tear or accidents, small fleet liability coverage is essential for protecting against legal repercussions arising from accidents, property damage, or injuries sustained on the job. Cargo protection plans are also vital, especially for businesses transporting valuable or perishable goods, ensuring that even if cargo is damaged or lost, it’s covered financially. By opting for tailored fleet policies, operators can have peace of mind, knowing their business and employees are shielded from financial vulnerabilities.

Tailored Policies: Protecting Your Business with Multi-Truck Coverage Options

Many small fleet operators often face unique challenges when it comes to insurance, as standard policies may not cater to their specific needs. This is where tailored fleet policies step in as a game-changer. By offering multi-truck coverage options, insurers can provide best-in-class protection for both the business and its valuable assets. These customized plans ensure that small fleet operators receive comprehensive fleet insurance, including top-rated trucking insurance, to safeguard against various risks.

One of the key components is physical damage insurance, which protects vehicles from unforeseen accidents or natural disasters. Additionally, cargo protection plans are essential for ensuring the security of goods during transit. Such tailored policies go beyond basic liability coverage, offering peace of mind and robust support, thereby solidifying their position as a top choice for small fleet owners seeking comprehensive fleet insurance solutions.

Cargo Protection and Physical Damage Insurance: Ensuring Peace of Mind

For small fleet operators, ensuring comprehensive protection is paramount to fostering peace of mind on the road. Cargo Protection and Physical Damage Insurance stand as cornerstones in this pursuit, offering best-in-class coverage that caters specifically to the unique needs of trucking businesses. These tailored fleet policies not only safeguard against potential physical damage to vehicles but also provide robust cargo protection plans, mitigating risks associated with goods-in-transit.

With top-rated trucking insurance options available, small fleet operators can access multi-truck coverage that suits their operations’ scale and complexity. This ensures that should unforeseen circumstances arise—be it an accident, natural disaster, or theft—the financial burden is mitigated, allowing business owners to focus on growth and efficiency rather than unexpected liabilities.

For small fleet operators, navigating liability risks is paramount. By securing the best coverage that combines comprehensive fleet insurance with tailored multi-truck coverage options, businesses can mitigate potential losses and enjoy peace of mind. Top-rated trucking insurance that includes cargo protection plans and physical damage insurance is essential for safeguarding assets and ensuring continued success. With these robust and inclusive policies in place, operators can focus on growing their fleets while remaining confident in their ability to handle any unforeseen challenges.