In the demanding trucking industry, top-rated trucking insurance is vital for balancing affordability with robust protection against unique risks like weather disruptions, cargo handling, and long-haul routes. Key factors influencing pricing include coverage scope, vehicle characteristics, driver records, location, and cargo type, with comprehensive policies costing more than basic liability. Leading companies achieve a balance through strategic risk assessment, partnerships with specialized insurers, and innovative solutions like telematics, enhancing safety, attracting drivers, and solidifying their position among top trucking insurance providers.

In the competitive world of trucking, selecting the right insurance policy is a delicate balancing act between cost and coverage. Affordability is key, but so are comprehensive benefits to protect against financial burdens. This article explores the nuances of achieving this equilibrium, especially in the context of top-rated trucking insurance. We delve into factors influencing affordability, strategies for securing robust benefits without breaking the bank, and real-world case studies showcasing successful balancing acts.

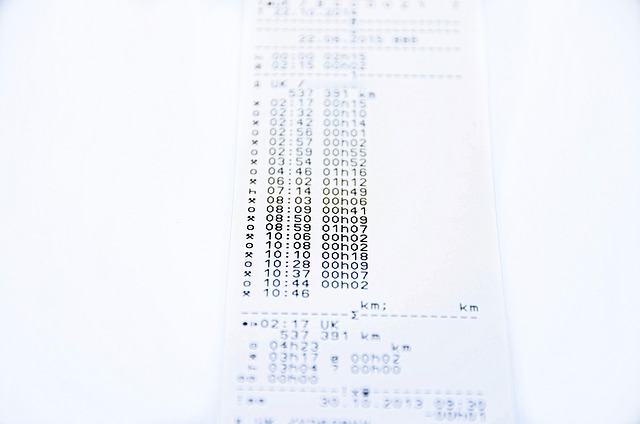

Understanding the Need for Balanced Insurance in Trucking

In the competitive world of trucking, where costs are high and operations are complex, finding a balance between affordability and superior benefits is paramount. Top-rated trucking insurance plays a pivotal role in this equilibrium. It’s not just about minimizing financial exposure; it’s about ensuring that your fleet and drivers have access to comprehensive protection tailored to mitigate risks specific to the industry. This includes coverage for cargo, liability, and even advanced roadside assistance, all while keeping premiums within budget.

A well-rounded insurance strategy recognizes that a “one-size-fits-all” approach won’t cut it. The diverse nature of trucking operations demands customized solutions. By understanding the unique challenges faced by trucking businesses—from unpredictable weather conditions to heavy cargo handling and long-haul routes—insurers can offer tailored policies that address these concerns effectively. This balance allows trucking companies to focus on what they do best, while armed with peace of mind knowing their assets and drivers are protected by top-tier insurance coverage.

Factors Affecting Affordability in Top-Rated Trucking Insurance

When it comes to affordability in top-rated trucking insurance, several factors play a pivotal role. Firstly, the type and scope of coverage sought significantly impact costs. Comprehensive policies that include protection against various risks like accidents, cargo damage, and liability will generally be more expensive than basic liability coverage. Secondly, the age and condition of vehicles are considerations; older trucks or those with higher mileage might require higher premiums due to increased wear and tear risks.

Additionally, the driver’s profile influences affordability. Safe driving records with no claims or violations lead to lower rates. Younger drivers or those with a history of risky behavior can expect higher costs. The location where the truck operates is another critical factor; regions with higher accident rates or specific regulatory requirements may result in more substantial insurance premiums. Lastly, the capacity and type of cargo being transported can affect affordability, as hazardous materials or high-value freight often necessitate specialized coverage.

Strategies to Secure Superior Benefits Within a Budget

When searching for top-rated trucking insurance, balancing cost and coverage can seem daunting. However, there are several strategies to secure superior benefits within a budget. Firstly, compare multiple quotes from different providers to find competitive rates. Don’t be tempted by the cheapest option; instead, focus on understanding each policy’s nuances. Consider your specific needs: comprehensive versus liability coverage, deductibles, and additional perks like roadside assistance can vary widely between plans.

Additionally, leveraging industry insights and negotiating tactics can help. Stay informed about common discounts offered by trucking insurance companies, such as safety incentives or loyalty rewards. Presenting this knowledge during negotiations could lead to significant savings. Remember, the goal is not just affordable coverage but a policy that aligns with your operational requirements while providing peace of mind.

Case Studies: Successful Balance in Action

In the competitive landscape of trucking, companies are constantly seeking a delicate balance between affordability and top-rated insurance benefits to protect their investments. Case studies from industry leaders highlight successful strategies in achieving this equilibrium. For instance, consider a mid-sized trucking company that, through careful risk assessment and partnership with specialized insurers, managed to secure comprehensive coverage at a cost 20% lower than the market average. They achieved this by implementing advanced telematics to monitor driver behavior, thereby reducing accidents and claims.

This approach not only enhanced their financial stability but also attracted and retained drivers due to the company’s commitment to safety and cost-efficiency. Similarly, another fleet operator focused on tailored policies, customizing their insurance to align with specific operational needs. By prioritizing high-quality customer service and leveraging digital tools for claims management, they achieved a seamless balance between affordability and superior benefits, positioning them as a top choice among top-rated trucking insurance providers.

In the competitive world of trucking, finding the perfect balance between affordable rates and comprehensive benefits is essential. By understanding the key factors influencing pricing and implementing strategic approaches, carriers can secure top-rated trucking insurance that meets their operational needs without breaking the bank. Through case studies showcasing successful examples, it’s evident that achieving this equilibrium is not only feasible but also a game-changer for businesses aiming to thrive in today’s market.